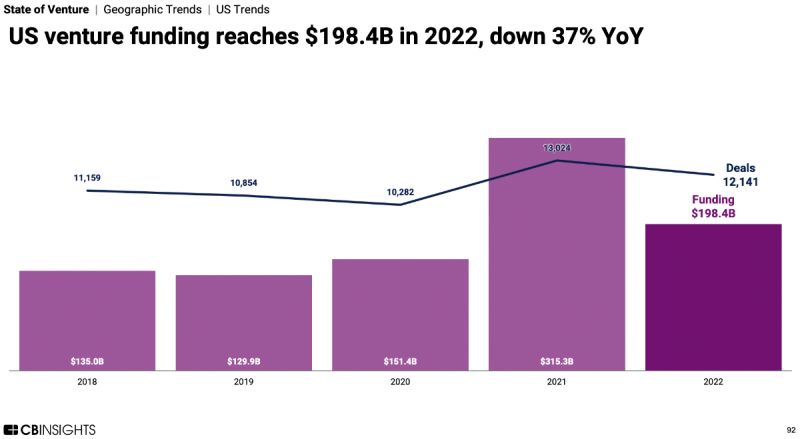

2022 global venture funding data shows a return to pre-COVID trends, with a YoY drop of 35%. IPOs were down 31%, SPACs down 41%, Unicorn births down 86%.

Interestingly, only 34% of US-based companies were funded last year which means VCs are truly going global.

Worldwide venture funding was $415.1B in 2022, marking a 35% drop from a record 2021.

The funding slowdown was especially severe in the second half of the year, with Q4’22 funding clocking in at $65.9B — down 64% YoY to return to pre-Covid levels.

US-based companies accounted for just under half (48%) of all funding and 34% of all deals in 2022.

Global IPO count dropped by 31% in 2022 to 716. M&A deals also took a hit, dropping by 8% to 10,037.

SPAC deals saw the largest drop among exits types in 2022, falling by 44% from their peak in 2021 (140) to 78.

Unicorn births steadily declined throughout 2022, sinking to a low of 19 new unicorns in Q4’22 — an 86% drop compared to Q4’21.

Data source: Anand Sanwal, CB Insights

#venturecapital #digitaltransformation #data #funding #angelinvesting