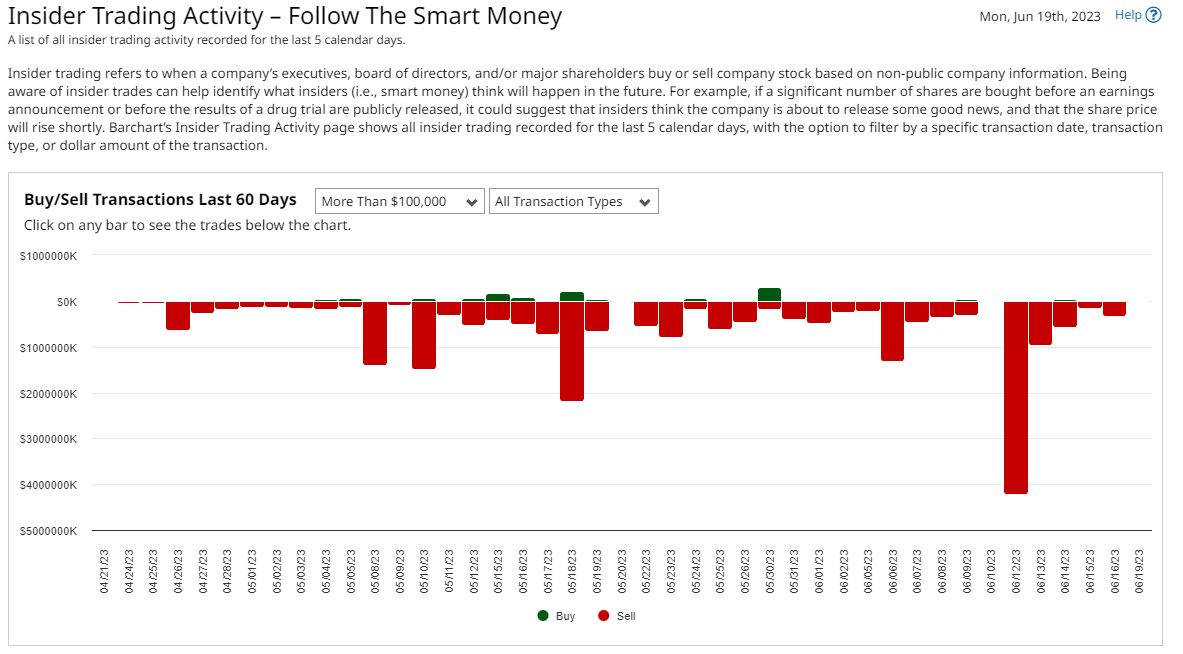

What are company insiders doing during an AI-fueled stock market rally? Are they buying more stock or are they selling?

Answer: They are selling.

Let’s take a look at a couple of market datapoints.

1. Most insiders (executives and others) have been sellers of their company’s stock and have not bought much stock. Which means they believe that this is the right price to sell stocks vs in the future.

2. The PEG ratio ( Price to Earnings Growth Ratio) for S&P 500 vs Technology is extremely elevated. A trend not seen since the dot com boom.

It is an interesting trend: Investors continue to invest in Generative AI companies which is fueling a stock market rally. And insiders continue to sell on market strength.

Is this a sign of new secular bull market or is it a short term bear market rally? Time will tell.

What are your thoughts on the rally so far?

#generativeai #investments #investing #aistocks

h/t to Barchart and Game of Trades.