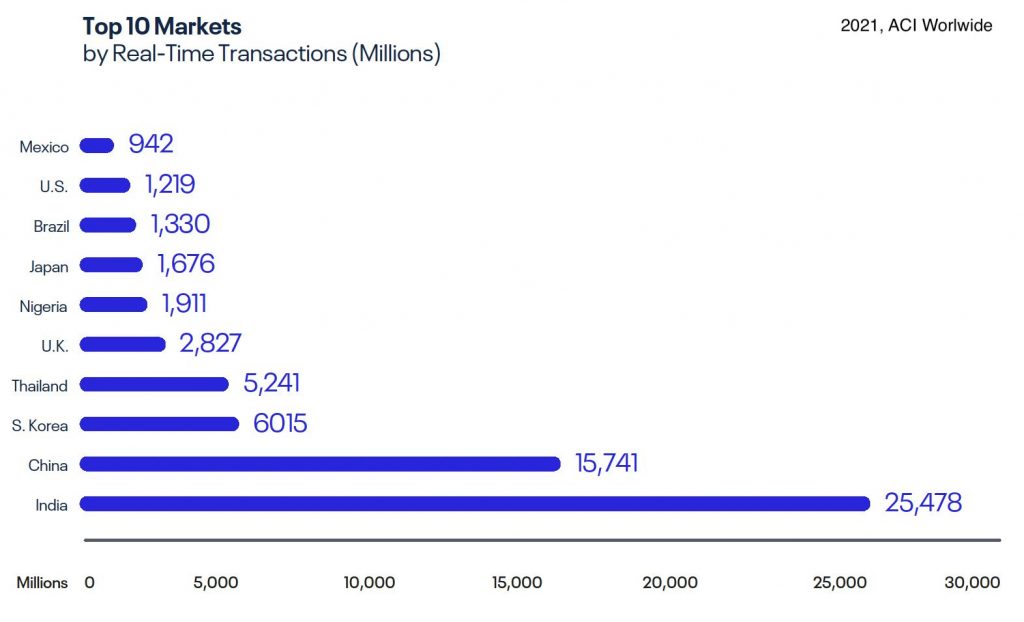

The world’s major economies are building the next big thing in their digital stack: real time payments.

India’s UPI platform is the current leader, with major competitors starting to appear on the horizon.

In 2021, over 40% of all global real time payment transactions originated in India. It is estimated that 70% of payments within India will be digital by 2026. A digital economy in the making.

It has been made possible due to Unified Payments Interface (UPI), an open stack system implemented in 2016. UPI was a response to the nation’s patchwork of rules and paperwork for payments, transactions on UPI have been growing at 160% CAGR.

Merchants in multiple countries are integrating India’s UPI stack for payments: Singapore, Malaysia, Thailand, Philippines, Vietnam, Cambodia, and Bhutan… with EU and Australia testing it’s integration with their own payment networks.

The reason for its increased adoption is that UPI has been shown to work well for a very large population. In addition, UPI has an open protocol upon which other technologies can be built, creating a much larger and more useful network than its competitors for financial payments.

Other countries are taking notice.

The current payments system in the US is ACH. You will get kick out of this: ACH transactions are processed using a flat file by end of each day.

Since it is batch processed, transaction processing can typically take several days, and at the earliest it will allow same-day settlement.

It also runs the risk of the sender having insufficient funds and the payment failing. Wires are immediate, but only operate during business hours.

Alternatives for real time payments in the US are Zelle, Venmo, Mastercard Send, and Visa Direct but they are for consumer accounts and for smaller amounts. Credit cards have a few days of settlement period so they are not exactly real time.

In August 2022, the U.S. Federal Reserve announced that its real-time payments network, FedNow, was finally going to launch in May or June of 2023. The highly anticipated new service, which will enable instant payments between accounts at participating banks at any time of day, has been contemplated by the Fed and others for over 10 years. More than 120 banks, payment processors, and gateways and others have since tried the service as part of a pilot program.

The evolution of real time payments is a major layer of the future digital stack.

Exciting times ahead!

#fintech #payments #digitaltransformation

Source: ACI Worldwide, CEBR, and Global Data